[INFOGRAPHIC] THE FIGHT FOR SMART SPEAKER MARKET SHARE

- WorldLine Technology

- Apr 23, 2019

- 3 min read

Updated: May 11, 2019

Credit from Nick Routley

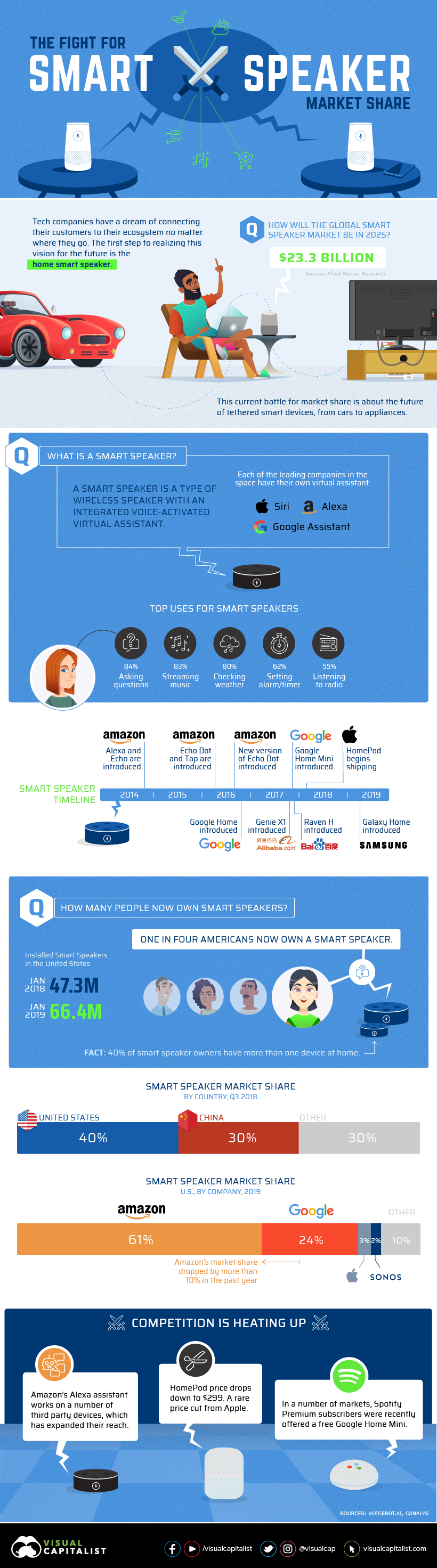

Tech companies are betting that the future of personal computing will be driven by the sound of your voice.

If they’re right, this early stage of smart speaker adoption will have a massive impact on future profits. Switching smartphone brands is relatively straightforward, but switching an entire voice assistant ecosystem? That’s not quite as easy.

Voice Assistants like Siri and Alexa will transform behavior inside the home. At the center of that behavior is a smart speaker, serving as the hub of a connected lifestyle.

– Andy Chambers, Vice President of Connected Home, Assurant

Today’s infographic is an overview of the rapidly expanding smart speaker market, and how the major players in the space are competing for critical early market share.

Moving Towards Majority

Adoption of smart speakers really began to gain traction with consumers in 2018, when the percentage of American adults with such a device passed the 20% mark. Today, the U.S. adoption rate sits at about 25%, and by 2022, it’s expected to more than double to 55%.

In just one year, China’s global share of the smart speaker market went from almost zero to 30%, and the country’s smart home market was valued at over $7 billion. Companies like Baidu and Alibaba are fighting their own battle for domestic market share.

Amazon’s Head Start

It has now been almost five years since Amazon announced Alexa and the Echo to the world, kicking off the age of the smart speaker.

The sting of Amazon’s failed foray into the smartphone market was still fresh, and the initial reaction to a device listening inside the home was mixed. That said, Amazon’s huge built-in customer base and two-year head start was enough to bag a hefty portion of the smart speaker market. Now, other brands are playing catch-up.

Here’s a look at U.S. smart speaker market share by device:

The Fight is Heating Up

Companies are responding to Amazon’s market dominance in different ways.

Apple recently dropped the price of its HomePod smart speaker to $299, a rare price cut for a company that is used to people lining up to buy its products. Unlike its competitors, Apple can’t go all-in on using the device as a “loss leader” to support advertising or e-commerce. HomePod is positioned as a more premium product, but price will be a sticking point for many.

Google, on the other hand, is taking a drastically different approach. The company released the Google Home Mini as a cost effective entry point for consumers looking to try out a voice-directed device.

As well, Google partnered with Spotify to offer Home Minis as a free promotion for Spotify Premium customers. Spotify’s premium user base is nearly 90 million, so if even a fraction of users take the free offer, a massive influx of Google smart speakers will enter the market.

Over the last year, Amazon saw over 10% of its market share chipped away by competitors, and Google accounted for about half of that loss.

What’s Next? It’s Hard to Say

With the promise of future connected home profits on the line, it’s hard to say what lengths companies will go to out manoeuver each other. One thing is clear though, the overall smart speaker market is still in the midst of a major growth cycle, and we’re just seeing the beginning of what’s possible with voice-directed devices.

Comments