How should brands change to fully capitalize on New Retail?

- WorldLine Technology

- Mar 20, 2020

- 6 min read

By AliResearch

From our experience, some brands are in a stronger competitive position to win in New Retail. These companies take a systematic approach that covers six well - defined steps.

Step 1: Identify new governance principles for a customer - centric model

The best brands redefine the relationship among consumers, merchandise and stores in a way that makes the most of their operations while strengthening such fundamentals as the operating model and ability to develop new technology (see Figures 3 and 4).

This starts by acknowledging—and acting on—two principles of New Retail. They put customers at the heart of operations, with full consideration of the end-to-end customer experience, from awareness to purchase to referral. In addition, they commit to embedding data and smart technology into their operations, breaking down the data silos within their organizations for cross-function interconnection and extending their links with the broader ecosystem.

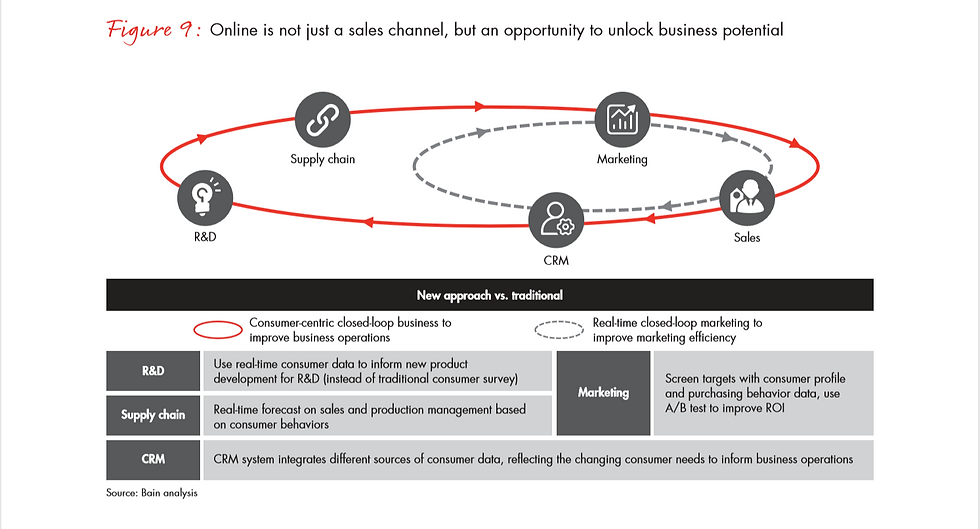

In the past, they may have used internal CRM data to inform functional business decisions in such areas as R&D and production, marketing and sales. Now they continually refine the data and expand their data sources through external partnerships, engaging in test-and-learn exercises to develop and act on broader, deeper and constantly changing consumer insights. They establish a two-way closed loop to connect internal and external data for smarter business decisions.

Step 2: Develop new flexibility and efficiency in R&D and supply chains

New Retail is having a big effect on every corner of a brand’s operations. As consumer needs become more diversified, the potential consumer pool would shrink if existing R&D and supply chain strategies remain unchanged. We see the best companies transforming those operations to take advantage of retailing’s new realities, and making them more efficient in the process. These brands use real, comprehensive and timely understanding of consumers to optimize R&D and their supply chains (see Figures 5 and 6).

For example, as they deliver personalized products and services, they thoughtfully adapt to shorter R&D cycles. Pioneering companies also take an interactive approach to R&D that allows for timely changes in design and planning based on real-time consumer behavior. Importantly, they view their consumers as participants in the R&D process, engaging with them early in product development, conducting consumer testing before production and connecting frequently before a product launch to enhance loyalty.

A brand’s customization model demands different levels of complexity in its R&D capability and supply chain. For example, it is possible to create a product mix that requires virtually no change in an existing supply chain. That would be the case when allowing customers to select slightly different shoe sizes for their left and right feet, or when offering personalized wine labels for birthdays or weddings.

However, the supply chain becomes more complex when a company integrates consumer ideas into production—enabling them to personalize the colors of outer packaging, for example. The highest degree of complexity happens when companies manufacture a product based on consumer needs, relying on consumer participation throughout the process, from ideation and R&D to marketing and sales.

To see customization in action, look no further than the whimsical Oreo Music Box, which Mondelez introduced on T - mall’s Super Brand Day 2017, with the goal of making Oreo;s more popular among teenagers, strengthening the brand’s emotional appeal to consumers of all ages and driving traffic to its T - mall store. The company created a truly inventive product: a turntable-like device that plays tunes when an Oreo biscuit is placed on it. Customers can change the prerecorded music simply by taking a bite from the Oreo and placing it back on the music box. They can also record their own voices and decorate the device, customizing it by scanning the QR code.

The music box is a good illustration of what it now takes to get ahead in New Retail. The company partnered with third - party vendors and T - mall in its development and marketing. In addition, by relying on a flexible supply chain, Mondelez was able to get the product to market in a record seven days, as opposed to the traditional two to three months. A New Retail success story, the “singing biscuits” generated 80 times more sales on Mondelez’s site than average, with 90% of the purchases made by new consumers.

Brands are making supply chains flexible enough to adjust to real-time front line sales results and the more accurate estimates enabled by artificial intelligence (AI), the Internet of Things (IoT), Blockchain and other emerging technologies. Companies selling in China are at the forefront of this movement to use smart technology. The most advanced among them integrate all the parties in the supply chain, analyzing the full spectrum of available data to improve visualization, analysis and supply chain automation (see Figure 7).

For example, a visualized real-time supply chain enables these companies to track cargo and machine information to quickly detect and solve problems. They rely on robots in factories. They develop smart analytics to streamline inventory forecasting and planning, as well as category selection, procurement, reallocation and replenishment. These companies make the required investments to choose the right service providers, manage the data and improve the operating efficiency of their supply chains.

Nestlé has reaped significant benefits from its “One Set Inventory” unified supply chain, which serves different channels (business-to-business, business-to-consumer, offline-to-online and others), sharing its logistics service and inventory (see Figure 8). From a single hub, Nestlé ships to different channels instantly, choosing the destination based on insights generated by real-time data. The move has dramatically improved turnover efficiency; the online product shortage rate has dropped from 22% to 5%. It has also lowered logistics costs, reducing cross-region delivery from 60% to 10%. In addition, the new supply chain setup has improved delivery timeliness for Nestlé. Now, nearly 80% of orders are delivered same day or next day.

Step 3: Reimagine marketing and consumer management for New Retail

New Retail changes the game in marketing and consumer management, too. The digital ecosystem that encompasses purchase, payment, delivery and all the other customer touchpoints provides the opportunity to reach consumers whenever and wherever they are online. That is why winning brands have extended the horizons for digital marketing. For them, online is not limited to a sales channel; rather, it becomes a consumer - centric closed loop for unlocking business potential (see Figure 9).

These companies collect data whenever a consumer uses an app to hail a taxi or process a payment. They integrate online and offline data, incorporating everything from the categories customers browse online to their responses to digital marketing to the frequency of visits to physical stores and the amounts they typically spend there. From this composite of transactions, brands gain insights that help them develop and deliver personalized marketing messages at the appropriate customer touchpoints, constantly refining what they learn and how they market. It is a major shift in philosophy that turns marketing from a brand expense into a brand asset.

Milk and infant formula producer Friso created an online closed loop to cover the stage gates of the consumer journey. The first stage involves identifying target consumers and customizing marketing information based on such elements as an individual’s stage of pregnancy or purchasing power. Friso then expands its marketing efforts to include multiple touchpoints such as popular social media platform Weibo and video websites to maximize brand exposure and accumulate consumer behavioral data. Finally, the brand continuously interacts with consumers via content marketing through its online membership platform, which enhances loyalty and provides more data for further marketing efforts.

Cosmetics brand Estée Lauder takes a similar approach, continuously building, refining and drawing from its consumer database (see Figure 10). To enhance awareness, the brand recently initiated a campaign in which it blended ads with content to reach targeted potential consumers in multiple channels. Its precise consumer profiling enabled it to connect with more than 10 million targeted consumers in six days and attract more than 100,000 new followers.

It then interacted with those consumers through diversified media, using each interaction as an opportunity to trace consumer behavior. (Traditionally, companies only track click-through rates without generating further insights.) This effort enabled Estée Lauder to reach more than 500,000 fans in a two-week period. About 12% of those consumers interacted with the brand and revisited the site to research or browse products. It then relied on Big Data to zero in on more than a million high-value, easy-to-convert consumers in its database and targeted them for resell. The effort boosted Estée Lauder’s conversion rate by 80% over previous approaches.

(To be continue)

Subscribe WorldLine Technology to be up-to-date the most innovative marketing technologies in the world.

Hotline: 0968 68 3191

YouTube: WorldLine Technology

Comments